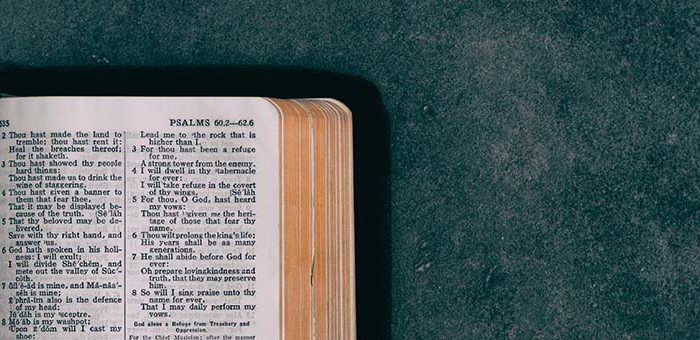

On March 15, 2019, a three-judge panel of the U.S. Seventh Circuit Court of Appeals overturned a 2017 lower court ruling and affirmed that the ministerial housing allowance is constitutional. This is good news for churches and their pastors, many of whom rely on the tax break.

The allowance, found in section 107(2) of the Internal Revenue Code, allows churches to either provide a parsonage or designate a reasonable part of a minister’s compensation package as a housing allowance that is then excluded from taxable income. According to the congressional Joint Committee on Taxation, the allowance saves ministers an estimated $700 million per year in taxes.

A similar challenge was rejected in 2014 on jurisdictional grounds. This time, the circuit panel found that the housing allowance does not violate the Establishment Clause of the first amendment to the U.S. Constitution. The decision noted that the housing allowance has been in place for decades and is parallel to housing allowances for some nonreligious vocations.

The Freedom from Religion Foundation of Madison, Wisconsin, which brought the suit, said it is considering a petition for rehearing to the full Seventh Circuit or an appeal to the U.S. Supreme Court.

View All Articles

View All Articles